Understanding Personal Finance: A Beginner’s Guide

Introduction to Personal Finance

Understanding personal finance is crucial in today’s world. Generally, it involves managing your income, expenses, savings, investments, and future financial goals. Each individual’s personal finance system is unique, and it’s important to understand and improve your financial health. In this article, we’ll explore the basic concepts of personal finance to help you enhance your financial situation.

Understanding Your Income

Your income is a vital part of personal finance. It consists of the money you earn from work, business, or other sources. Managing your income is essential to effectively plan your expenses and savings. This means understanding your total income and assessing how much is available for your basic needs and future goals. Proper income management will aid in achieving financial stability and growth.

Budgeting Basics

Budgeting is a crucial tool that helps you control your finances. It helps you decide how much of your income will be allocated for daily expenses, savings, and investments. Creating a budget allows you to track your spending habits and cut down on unnecessary expenses. An effective budget will assist you in achieving your financial goals and give you a clear picture of your available funds.

Saving for Emergencies

Emergency savings are funds reserved for unexpected expenses. It’s important to maintain an emergency fund that can cover 3-6 months of living expenses. This fund protects you from financial emergencies, such as medical emergencies or job loss. Regular contributions to your emergency savings provide peace of mind and financial security.

Debt Management

Debt management is a critical aspect of personal finance. When you have loans and credit card balances, it’s important to manage them and make timely payments. High-interest debt should be paid off quickly to avoid excessive interest payments. Debt consolidation and refinancing options can offer lower interest rates and better payment terms. Effective debt management improves your financial health and provides financial freedom.

Investment Fundamentals

Investment is a key tool for growing your wealth. Options like stocks, bonds, mutual funds, and real estate are available. Before investing, it’s essential to understand your risk tolerance and financial goals. Long-term investments generally offer higher returns but come with risks. Diversification, or spreading investments across various assets, helps minimize risk.

Retirement Planning

Retirement planning is a critical step for your financial future. It’s important to define your retirement goals early and start saving and investing for them. Retirement accounts, such as 401(k)s and IRAs, offer tax benefits and long-term growth. Ensure you accumulate sufficient funds for a comfortable retirement.

Tax Planning Strategies

Tax planning is a crucial part of your overall financial strategy. Efficient tax management can positively impact your income and savings. Utilize tax deductions, credits, and exemptions to minimize your tax liabilities. Tax-advantaged accounts and investments can also help reduce your tax burden. Effective tax planning aids in achieving your financial goals.

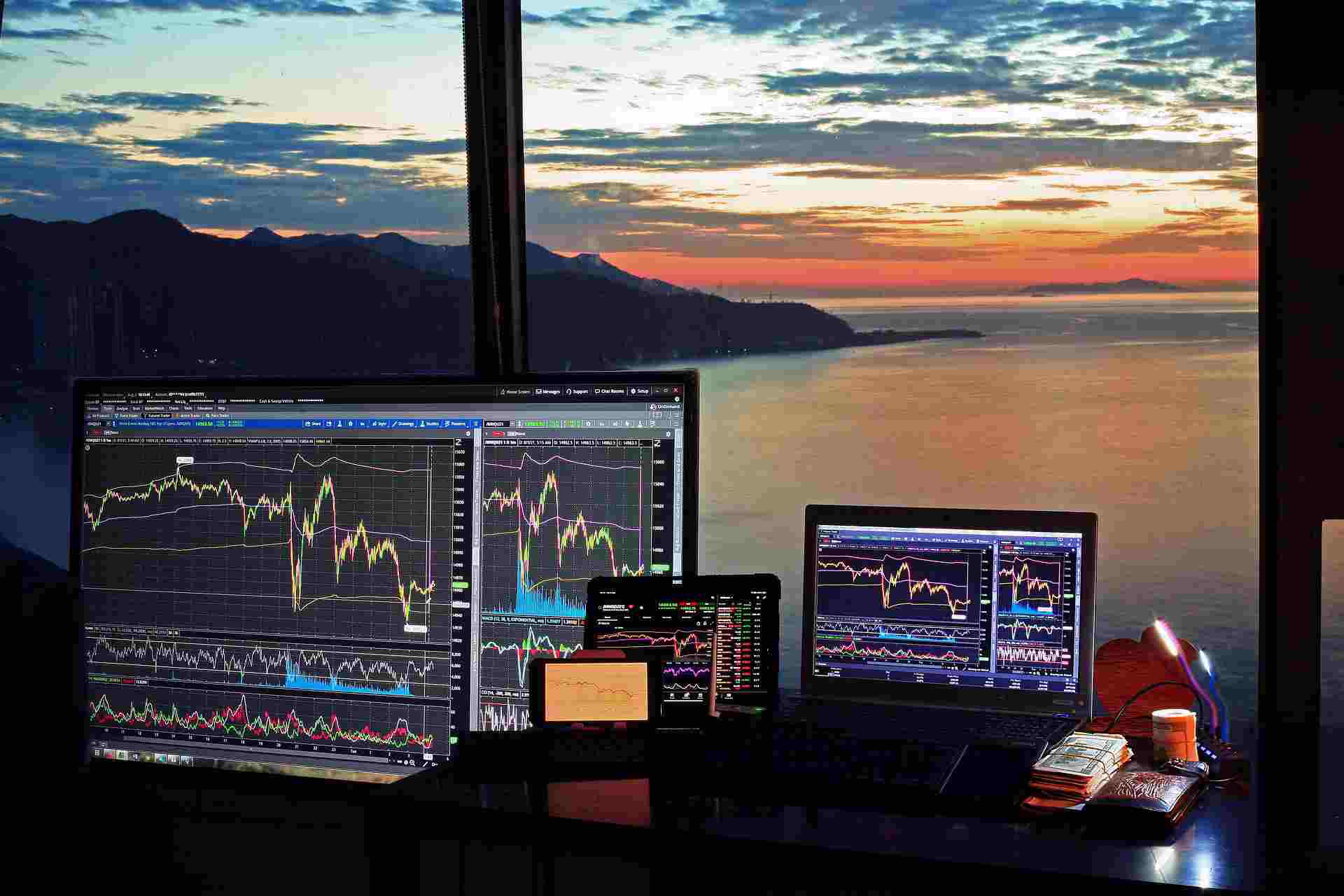

Building Wealth Through Investments

Wealth building can be achieved through investments. It’s important to view investments from a long-term perspective and monitor market trends. Consider diversified investment options like mutual funds, ETFs, and real estate for wealth building. Regular investing and leveraging compounding benefits can help grow your wealth. Financial discipline and strategic planning are key to wealth accumulation.

Understanding Financial Risks

Understanding and managing financial risks is essential for maintaining financial stability. Risks such as market risk, credit risk, and inflation risk can affect your investments and savings. Risk assessment and management strategies, like insurance and diversification, protect you from financial losses. Effectively managing financial risks secures your financial future.

Insurance as a Safety Net

Insurance is an important aspect of personal finance that protects you from unexpected financial losses. Health insurance, life insurance, and property insurance ensure your financial security. When choosing insurance plans, consider coverage options, premiums, and claim processes. Incorporating insurance into your overall financial plan ensures you are financially prepared for unforeseen events.

Estate Planning Essentials

Estate planning is crucial for managing and distributing your assets. It includes wills, trusts, and power of attorney, which manage and distribute your assets after your death. Estate planning provides financial benefits to your heirs and minimizes estate taxes. Regularly review and update your estate planning to ensure your wishes are properly executed.

Financial Goals Setting

Setting financial goals is a fundamental part of personal finance. It’s important to establish clear and achievable goals to guide your financial planning. Define both short-term goals, like vacation planning, and long-term goals, like home purchase. Implement budgeting, saving, and investing strategies to achieve these goals. Regularly review and adjust your goals to track your financial journey.

Tracking Financial Progress

Tracking your financial progress helps assess your financial health and identify improvements. Regularly review your budget, savings, and investments, and analyze financial reports. Financial tracking tools and apps assist in monitoring your progress. Tracking progress allows you to achieve your financial goals efficiently and make timely adjustments.

Conclusion: Taking Control of Your Finances

Understanding and controlling personal finance is essential for financial stability and growth. It’s important to effectively manage your income, expenses, savings, and investments. Through budgeting, saving, and investing, you can achieve your financial goals and ensure future financial security. Financial planning and management can lead to a financially secure and prosperous life. Take action now to improve your financial health and move towards a better financial future.